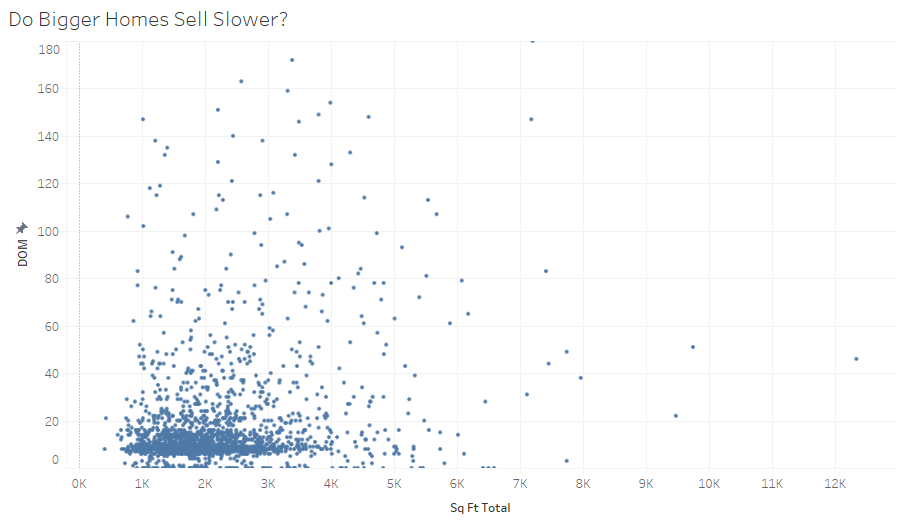

Yes they are. The correlation is not as dramatic as common sense might suggest, but this is partially because slow-moving homes come in two flavors: truly unique properties with a small universe of potential buyers, and mispriced homes. As we have seen above, there are slow-moving homes at every price range, so this masks the correlation between longer DOM and unique properties.

Conclusion: Both Average and Median Sales Price are related to Days on Market: more expensive homes take longer to sell. The correlation is not as strong as most might expect.

Listing Period Vs Days On Market

To compare apples to apples, sellers must remember that a Listing Period (the time your agent has exclusive permission to represent your home for sale) is not the same as the Days on Market. The Listing Period is actually the sum of all the prep time (preparing disclosures, property inspections, potential repairs, painting, staging, photography, videography, marketing, broker tour, and much more) plus the actual time it takes your home to sell.

But Still, Quicker is Better, Right?

Not always! The best price from the best buyer is usually what we try to optimize for. Speed is good, but only if we are sure that we are getting every possible offer that could maximize the return on your investment. Sometimes an auction model and its deadline-based approach is right for certain properties, but not always.

The clients of the Young Platinum Group, and of Golden Gate Sotheby’s International Realty in general, often possess truly distinctive properties which are unique, bespoke, and extraordinary. These are often not mass consumption dwellings, but very custom expressions of personality. Such homes can often be in that “10% of Palo Alto that does not sell in less than 40 days” bucket in the chart above.

Conclusion: 90% of Palo Alto homes sell in under 39 days of going on the market. Unique, expensive homes are more likely to take more time.

In Summary

· Days on Market has been remarkably stable over the past 5 years; the median home sells in 9 days.

· The timing within the year when a home is listed does not materially affect its speed to sell.

· Home size, lot size, and sale price are not strongly correlated with how long a property remains on the market, though sale prices above $4,000,000 do seem to suggest longer times to sell.

· Both Average and Median Sales Price are related to Days on Market: more expensive homes take longer to sell. The correlation is not as strong as most might expect.

· 90% of Palo Alto homes sell in under 39 days of going on the market. Unique, expensive homes are more likely to take more time.

Data analysis is great for macro-trends, but your home is assuredly not macro! Each property will have relevant comparables that may make your situation unique. The Young Platinum Group would be delighted to consult with you regarding your specific opportunity.