How We Help You Sell

Select Transactions (Sellers)

Keep Your Cash Sell Your Home

A Move-In Ready Home Sells For More

Maximize Your Sale Price with Superior Marketing

Our Process Reduces Risk

Save Your Time and Feel In Control With Concierge Service

All Articles

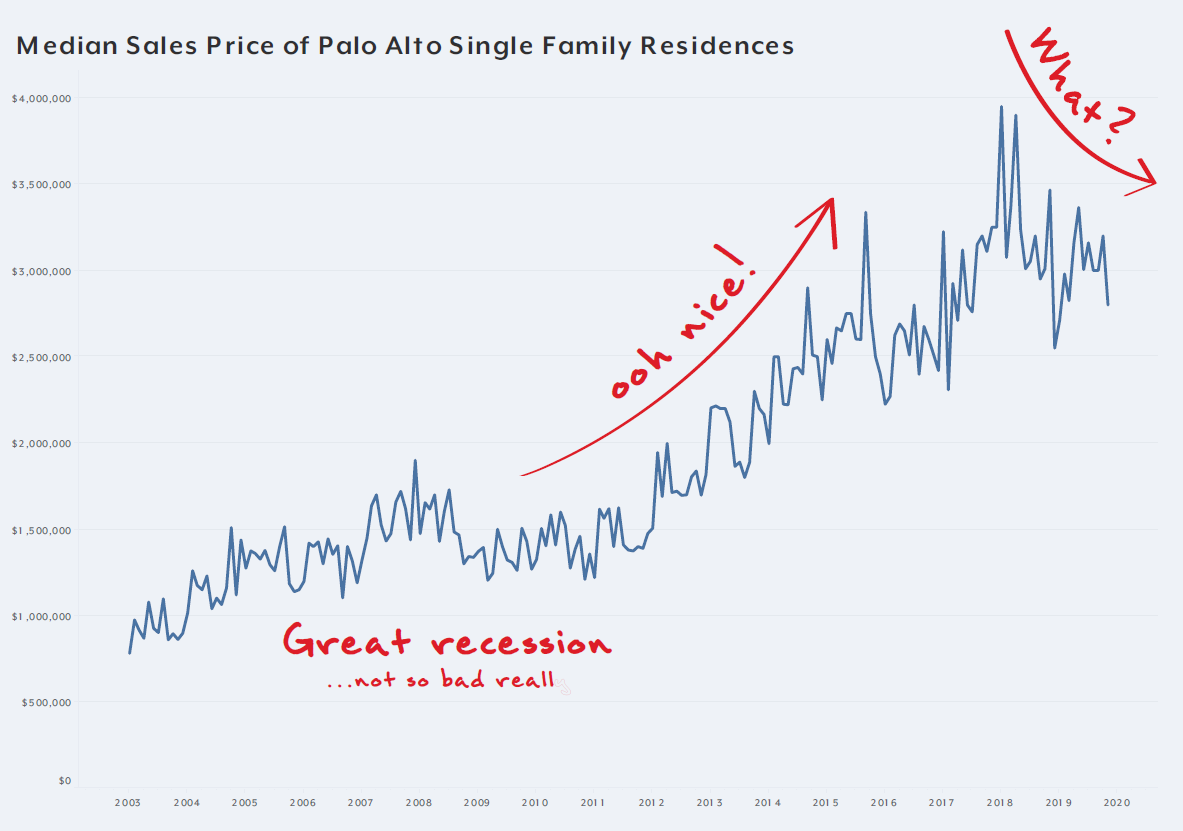

Will Palo Alto Home Prices Crash?

Luxury Outlook 2024 Mid Year Report

Buyer Case Study: Finding Off-Markets for Anita

Luxury Outlook 2025

13 Pictures That Explain the North Palo Alto Real Estate Market

The Mirage of Palo Alto's Falling Home Prices

Building 60 Shearer

How To Prep A House For 419% ROI

How Much is My Crescent Park Home Worth?

Silicon Valley Interactive Map

10 Intriguing Maps of Palo Alto

Case Study: the Transformation of 1220 Pitman

Exodus from Silicon Valley? Not in Housing!

How Recession-Proof Are Palo Alto and Atherton Home Prices?

Atlas of Luxury 2020

What Are the Best Investment Neighborhoods in Silicon Valley?

Current Market Report

Gateway Magazine

Reside Magazine